Employers

Program details

Eligible Connecticut businesses are required to facilitate MyCTSavings if they don’t offer a retirement plan

Newly eligible businesses

August 31, 2025

Next deadline

Businesses previously notified

Your registration deadline has passed

Your business should have received notifications that you must sign up for MyCTSavings or certify exemption from the program.

Don’t wait — take action today.

Employer eligibility

You’re required to register if you:

Have 5 or more employees*

Do not offer qualified retirement plan

Registration information

To begin, you’ll need your:

Federal Employer Identification Number (EIN)

MyCTSavings Access Code from your notification

Don’t have your Access Code?

If you are unable to find the Access Code for your business, you can look it up online

Already offer a retirement plan?

Employers who provide a qualified retirement plan to their employees should certify their exemption from the program using their provided Access Code.

Your responsibilities as an employer

We know that running your business is your top priority. That’s why MyCTSavings is easy to set up and requires only light account maintenance. The process takes just three simple steps. We’ll take care of the rest, at no cost to you.

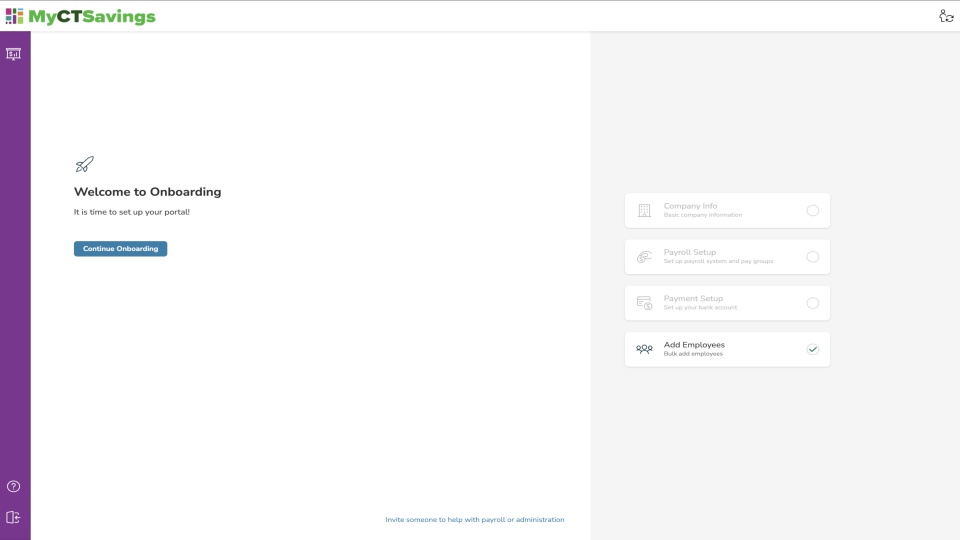

Onboard your company for MyCTSavings

There are just a few steps you need to take to get started. Take a look at this video to get you acclimated:

Resources

Registration

Contributions

Maintenance

Things you won’t be responsible for:

Enrolling employees into their MyCTSavings Roth IRA.

Answering questions about MyCTSavings and its investment portfolios, or helping employees choose investments.

Managing MyCTSavings investment options and processing employee investment change requests.

Processing distributions from employee investment accounts.

Managing employee investment account changes. Your employees will be responsible for maintaining their account information and settings if enrolled.

Still Have questions?

We have answers in our FAQs.

Details on how to use your account and other information about the program can be found in our FAQ section.

Reference

*A qualified employer is any employer, whether for profit or not for profit, that had five or more employees in Connecticut on October 1 of the prior year, at least five of whom were paid $5000 or more in taxable wages in the prior year. Qualified employers do not include those who were not in existence at all times during the current and preceding calendar years, and they do not include any employer employing only individuals whose services are excluded under the unemployment compensation law.